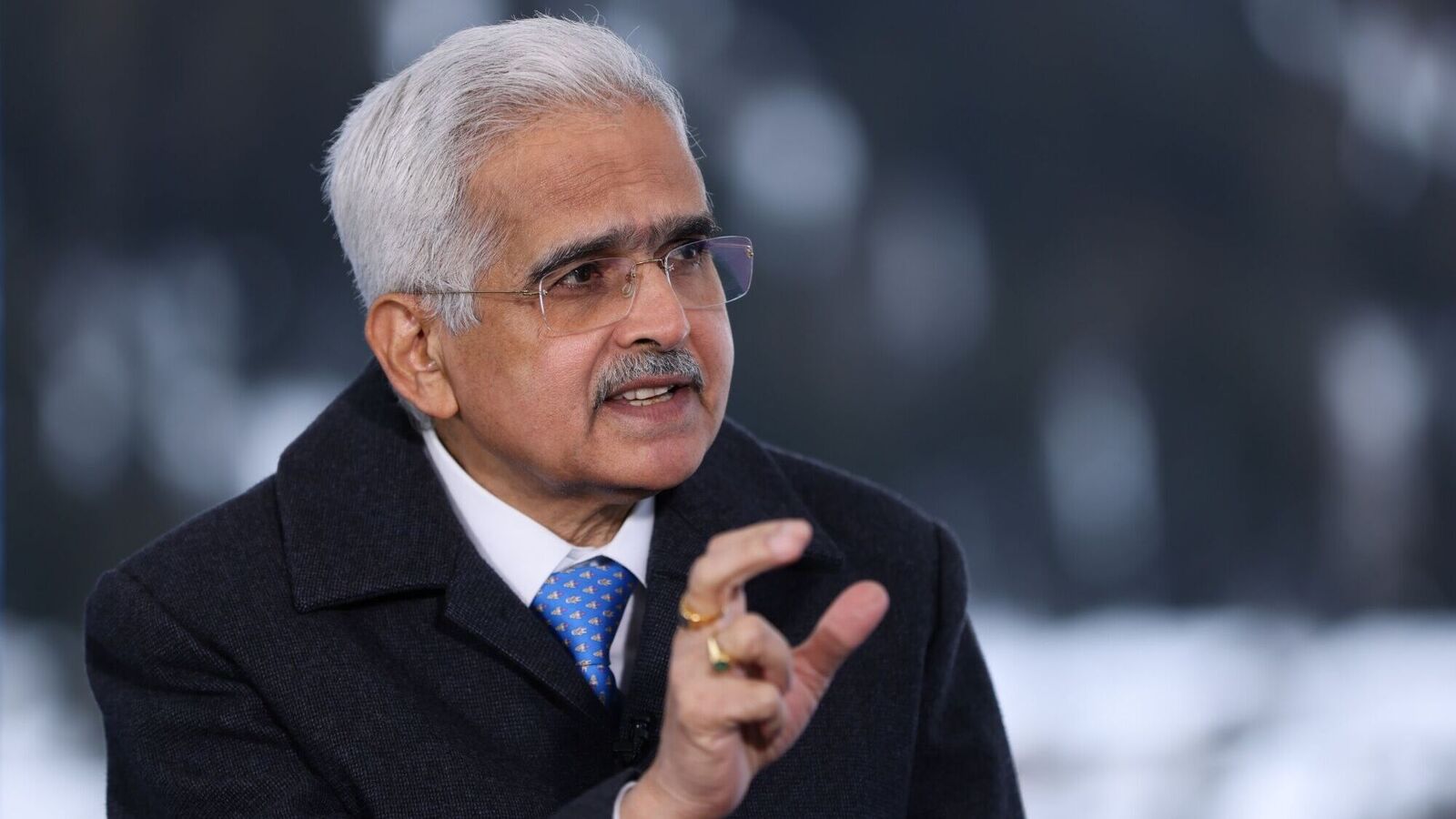

Exactly a week to the day that India’s Finance Minister Nirmala Sitharaman presented her pragmatic/no-nonsense/business-like/no-frills/poll-gimmick/farewell budget (take your pick, depending on your political proclivities), the Reserve Bank of India (RBI) did an encore. Presiding over his 32nd Monetary Policy Committee (MPC) meeting, Governor Shaktikanta Das announced a status-quo policy with no change in either the repo rate (at which the central bank infuses liquidity into the system) or stance (focused on withdrawal of liquidity).

Despite mounting pressure from market aficionados to take his foot off the brake and signal a return to easy money, the MPC stood its ground. The only difference between its latest resolution and its earlier one in December is that this time, MPC member Jayanth Varma dissented on both the repo rate decision as well as stance! It did not change anything. The MPC stayed put. The war against inflation is not yet won.

It’s a different story on the growth front. If the FM was measured in her praise of the economy during her budget speech, contenting herself with saying it is doing well, Governor Das was more emphatic, citing the government’s 7.3% growth estimate for 2023-24 while keeping RBI’s inflation estimate unchanged (5.4%). “The Indian economy has performed remarkably well in the recent years. Growth is accelerating and outpacing most forecasts, while inflation is on a downward trajectory.”

Earlier, in Davos, Das had declared, “Fiscal consolidation is on course and its quality has improved.” That was almost a fortnight before the FM presented her fiscal scorecard showing she has indeed lived up to the governor’s faith in the government’s commitment to fiscal rectitude. On paper, the lower-than-budgeted fiscal deficit (5.8% of GDP as against the budgeted 5.9%) should have eased pressure on RBI and granted it the luxury of taking its eye off one of the many balls it juggles—managing the government’s borrowings—while focusing on reducing inflation to 4%.

Except that the governor, wisely, kept his and the MPC’s eye on the long haul: “The MPC will carefully monitor any signs of generalization of food price pressures which can fritter away the gains in easing of core inflation. Monetary policy must continue to be actively disinflationary to align inflation to the target of 4% on a durable basis.” He added, “The MPC also decided to remain focused on withdrawal of accommodation to ensure fuller transmission and anchoring of inflation.”

While giving credit to the government, “Monetary policy was supported by pro-active supply-side measures by the government,” he made no bones about the fact that, “The job is not yet finished, and we need to be vigilant about new supply shocks that may undo the progress made so far.”… ‘Importantly, the CPI inflation target of 4% is yet to be reached.”

Das then walked his talk. Aware that monetary policy acts with long lags and, thanks to its broad-brush approach, is often regressive. An easy money policy leads to inflation and ends up hurting the poor far more than the rich. And, for all the talk of inflation being “stable and within the notified tolerance range of 2-6%” as stated by the FM in Parliament a day earlier, it is far from obvious how much of the reduction in inflation is due to monetary-policy actions and how much due to government measures (of which lentils to be sold below market prices under the label Bharat Dal is only the latest example). He probably also knows a time of reckoning will come, but later. In all probability, after elections, in the form of a wider fiscal deficit!

Hence, the need to remain “vigilant.” Indeed, the language of Das’s speech was more hawkish than earlier, with repeated references to a need to stand his ground. No one can complain he did not make himself clear. His speech and post-policy press conference made it amply clear he sees no contradiction between RBI’s stance and liquidity.

Market mavens can count themselves lucky. Unlike Jerome Powell, who seems to be following in former Fed Chair Alan Greenspan’s footsteps, Das does not speak in riddles. Contrast Powell’s reply when asked what conditions needed to be in place for an eventual rate cut, “It doesn’t need to be better than what we’ve seen, or even as good. It just needs to be good,” with Das’s “Monetary policy, in the midst of these lingering uncertainties, has to remain vigilant to ensure that we successfully navigate the last mile of disinflation.” Inflation is on the policy radar. Growth can take care of itself, thank you. And that’s unambiguously good news for the aam aadmi!

#RBI #Governor #Shaktikanta #Das #encore #budget